Author: Stephan Siehl – General Manager/ CEO at KMS Mobility Solutions GmbH

Date of Publication: : 7th May, 2025

Introduction: The classic leasing model is under pressure

Leasing has been the backbone of automotive financing for decades. The combination of fixed monthly instalments, tax advantages and predictable vehicle use made the model particularly attractive for business customers and fleet operators. However, the world of mobility is changing rapidly. Technological innovations, changing customer behavior, regulatory pressure and new competitive models are turning the industry on its head. Traditional leasing companies are under increasing pressure to transform.

In Germany in particular, one of the largest leasing markets in Europe, there are increasing signs of structural change. More and more customers - both private individuals and companies - are demanding different things: more flexibility, shorter contract terms, fully digital processes and significantly less administrative effort. At the same time, new competitors are entering the market with more flexible offerings such as car subscriptions that respond better to these needs. If you want to be successful in the future, you have to face up to these realities - and develop suitable answers.

1. Change in customer behavior: Flexibility instead of fixed terms

The demand for shorter leasing terms is increasing significantly. According to the Dataforce Leasing Study 2024, 20% of private leasing customers in Germany now prefer contract terms of less than 24 months. While 36- and 48-month contracts were the norm in recent decades, new usage patterns are emerging today. More and more customers want to change their vehicle more frequently, do not want to commit to long-term technology (e.g. with regard to e-mobility) or are planning temporary requirements (e.g. parental leave, trial phase at work, new life circumstances).

In the fleet sector, the picture is somewhat different: 36-month leases with high annual mileage (Ø 30,000 km) continue to dominate. But even here, according to the study, around 10% of corporate customers opt for long-term or short-term leasing - for example for employees on probation, seasonal order peaks or project teams. The demand for more flexibility and mobility solutions that can be called up at short notice has therefore also arrived in commercial use.

2. Car subscriptions are booming: new usage patterns, new business models

The logical consequence of these trends is the success of car subscriptions. According to the CAR Institute and FAAREN Report, subscription-based mobility solutions are recording annual growth rates of 30-40%. In 2022 alone, around 63,000 new car subscription contracts were concluded in Germany. The estimate for 2023 was already over 100,000. According to scenarios, there could be up to 500,000 or even 1 million active subscription users by 2030 - a figure that could surpass private leasing in terms of size.

The subscription model strikes a chord with the times:

- The subscription model strikes a chord with the times:

- All-inclusive rates with insurance, taxes, maintenance, tires and service

- Digital booking & administration, often without paperwork or physical contact

- Cancellation periods of between one month and three months

According to FAAREN Group Auto Abo Report 2025, the average term is 9.8 months, with over 70% of contracts falling into the 6 to 12 month range. What is particularly striking is that the subscription factor - i.e. the proportion of the instalment to the list price of the vehicle - is currently just 1.31% (private), a historic low. This makes the subscription model attractive even for cost-conscious customers.

In addition, according to ViveLaCar, 82% of subscription users are new customers who were not previously connected via traditional leasing or financing models. These user groups are young, urban and digitally savvy - and therefore often difficult to reach via conventional channels. Car subscriptions open up completely new target markets here.

3. Between use and ownership: customer preferences are differentiating

Today, many end customers no longer want to own cars - they want to use them. The classic ownership model is losing relevance. According to a survey by BearingPoint, only 16% of consumers still clearly prefer vehicle ownership to flexible access (subscription, sharing, rental). This attitude is particularly strong in urban regions and among younger target groups (Gen Y & Z).

However, leasing often remains cheaper in terms of monthly instalments - which is still attractive for price-conscious buyers. Nevertheless, the line between leasing and subscription is becoming increasingly blurred: many providers are extending return options, making terms more flexible or incorporating purchase options into subscription models (so-called ‘subscription-lease hybrids’). The market is developing in the direction of a supply logic based on the principle of ‘customized mobility’. Customers can switch seamlessly between subscription, rental, leasing or purchase, depending on their life situation. This is precisely where the potential for leasing companies lies.

4. New competitors & disruptive OEM models

The established players are confronted with new business models. OEMs such as Tesla, BYD and Polestar are pursuing radical strategies: Direct sales without discounts, digital self-service processes, own financial service providers, aggressive price adjustments. Take Tesla, for example: multiple price reductions within a year have led to massive losses in residual value. Sixt alone expects to lose around €40 million in 2023 due to such distortions.

This dynamic puts traditional leasing companies under pressure. Nowadays, vehicles must be handled quickly, used flexibly and managed efficiently . Leasing providers that continue to rely on rigid structures run the risk of losing customers - or even being forced out of the market completely.

5. What business customers really expect

B2B business is no longer just about price and duration. Today, fleet managers and mobility decision-makers expect:

- Digital tools for managing contracts, user data and vehicle fleets

- Real-time reporting on CO₂ emissions, costs and mileage

- Modular use with the option to temporarily top up or swap vehicles

- Transparent billing - even for mobility budgets

- Service excellence in the event of damage, maintenance and returns

Rigid fleet structures are becoming a problem, especially with hybrid working models (home office, changing project locations, etc.). This is where the subscription model, combined with leasing, car sharing and rental options, scores highly. The role of the leasing company is changing from financier to mobility integrator.

6. Strategic response: One-OS as an enabler for new business models

The biggest challenge for many leasing companies lies in implementation: how can the technological leap be made without jeopardizing day-to-day business? How can different mobility offers - leasing, rental, subscription - be managed efficiently and scaled flexibly at the same time?

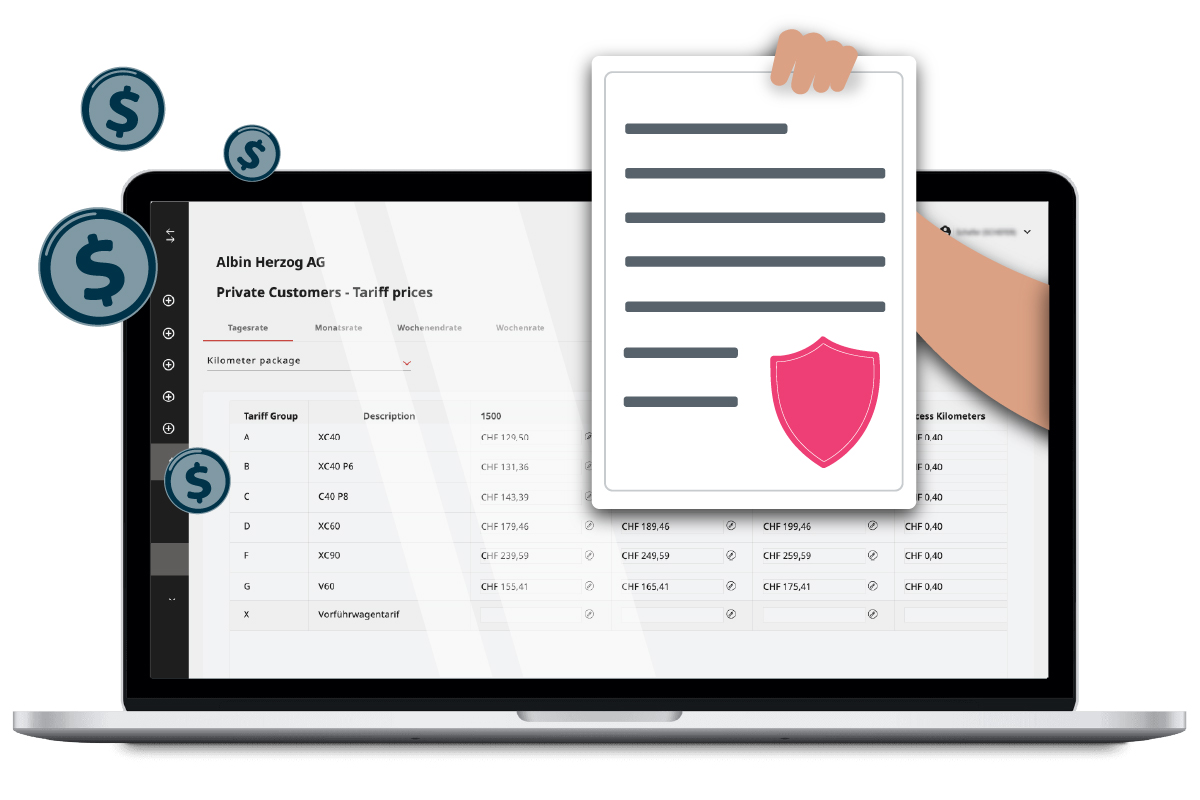

One-OS from KMS Mobility Solutions provides the answer:

- A platform for expanding usage scenarios to include subscription & rental in addition to leasing

- Seamless integration of B2B and B2C channels

- Digital checkout routes with online payment, verification, credit check

- Vehicle pools for multiple use and capacity optimisation

- Multi-client capable administration for multi-brand and multi-site operation

- Standardised interfaces to DMS, accounting, payment, vehicle data & images

One-OS makes it possible to place vehicles flexibly on the market - be it via own online stores, white label solutions for partners or via closed operator models. At the same time, operational processes are automated: from contract conclusion to digital returns with claims management. This allows leasing companies to act quickly, cost-efficiently and scalably.

Conclusion: Take action now - or lose the momentum

The industry is at a turning point: customers are demanding flexible utilisation instead of rigid ownership models. New competitors are setting digital standards. Manufacturers are pushing into the market with their own platforms. The traditional role of the leasing company is up for grabs.

But now is also a historic opportunity: those who actively shape digitalisation can tap into new target groups, generate additional business and position itself as a more future-orientated mobility provider. One-OS provides leasing companies with the technological foundation for this - without expensive in-house development, but with maximum freedom of design.

Leasing was yesterday. Mobility is today. Are you ready?

Sources: Current figures & insights from the FAAREN Abo Report 2025, the CAR-Institut in Duisburg, Dataforce, »kfz-betrieb«/Roland Berger and furthermore.